Defense Tech

Sweden Moves to Boost Defense Expenditures

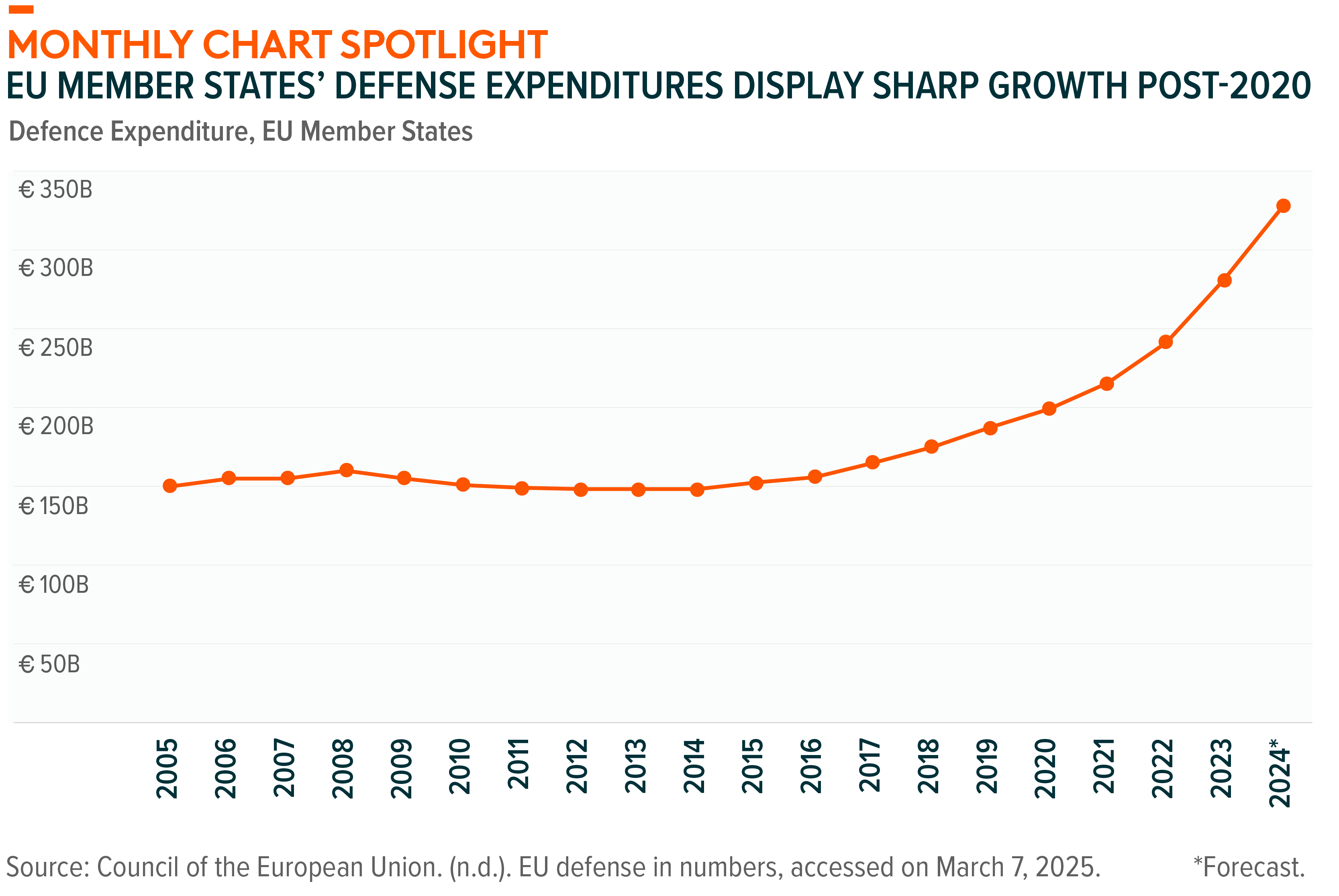

Sweden announced plans to increase its defense spending by $30 billion, aiming to allocate to 3.5% of its GDP to defense by 2030, up from 2.4% currently. The increase is part of Sweden’s largest rearmament initiative since the Cold War, driven by concerns over reduced U.S. support for European security. Sweden also increased its budgeted financial aid to Ukraine for 2025 from SEK 25 billion to SEK 40 billion, or approximately $2.5 billion to $4 billion. To fund these initiatives, the government plans to raise loans amounting to SEK 300 billion, or about $27.5 billion, by 2035. These moves align with a broader trend among European Union nations to boost military spending in response to evolving security challenges. Germany, for example, has significantly increased its defense budget and is permanently stationing troops in Lithuania for the first time since World War II.1

U.S. Infrastructure

America Receives Its Highest Infrastructure Score Ever

The American Society of Civil Engineers (ASCE) released the 2025 version of its quadrennial Report Card for America’s Infrastructure. The country’s overall grade rose to a C in 2025, up from a C- in 2021, with the uptick in federal and state funding helping to bolster scores across several segments. The C is the highest overall grade received since ASCE issued its first report card in 1988. The latest report, however, emphasizes that significant, sustained investments into U.S. infrastructure are necessary for it to improve and garner an acceptable level, which is a B grade. The Energy, Aviation, Transit, Roads, Dams, and Wastewater segments scored in the D range, meaning they have “Poor, At Risk” status and require significant attention. The ASCE estimates $9.1 trillion is needed over the next decade for the U.S. to improve the quality of its infrastructure assets. Segments with the highest investment needs include Energy, Roads, Schools, Wastewater, and Drinking Water.2

Artificial Intelligence

AI Players in a Product and Revenue Sprint

At its annual GTC AI Conference, Nvidia introduced the Blackwell Ultra and Vera Rubin, its most powerful AI chips to date amid escalating demand for AI applications. Set for release later this year, the Blackwell Ultra offers a 50% performance improvement over current models. The Vera Rubin platform, expected in 2026, will deliver even greater advancements, and in 2027, the release of Vera Rubin Ultra should offer 14 times the computing performance of Blackwell.3 On the private venture side, OpenAI expects its revenue to triple from $3.7 billion in 2024 to $12.7 billion in 2025 as adoption of its products has continued to grow rapidly. In March, OpenAI rolled out a new image generator in ChatGPT with enhanced picture editing, text rendering, and spatial representation.4 OpenAI competitor Anthropic’s annualized revenue reached $1.4 billion in March, a 40% increase from $1 billion at the end of 2024. At that rate of growth, projected 2025 revenue for Anthropic is between $2 billion and $4 billion.5

HealthTech

Generative AI Lends a Helping Hand in Healthcare Documentation

Novo Nordisk, the maker of Ozempic, is using generative AI to transform its pharmaceutical documentation processes. After implementing Anthropic’s AI model Claude 3.5 in autumn 2023, Novo Nordisk reduced the time required to compile regulatory documents from 15 weeks to under 10 minutes. Documentation tasks that previously involved over 50 employees and took several months are now managed by just three people in minutes. Also, Novo Nordisk has not only accelerated the preparation of clinical study reports for drug approvals, but it has also minimized errors through retrieval-augmented generation (RAG), a technique that reuses previously approved formulations. Notably, Novo Nordisk has not reduced headcount as part of this transformation. Instead, the company is reallocating personnel to other departments to enhance its overall efficiency. This type of generative AI deployment exemplifies how it can help healthcare streamline critical processes, accelerate innovation, and, ultimately, improve patient care.6

Cybersecurity

Growing AI Adoption Has Increased Cyber Investments

Google reached an agreement to acquire Israeli cloud security startup Wiz for $32 billion, its largest acquisition ever. Founded in 2020, Wiz reached $100 million in annual recurring revenue (ARR) in just 18 months. In 2024, the company serviced over 40% of the Fortune 100 companies and reached $500 million in ARR, largely fueled by the advancing cyber and AI threat landscape.7 AI workloads require scalable and resilient cloud environments, making security a critical differentiator in the cloud market. The acquisition, a major response to these evolving demands, enhances Google’s security posture and appeals to enterprise customers with increasingly complex needs. The deal also reflects a broader trend among big tech firms to bolster their cloud offerings through acquisitions, partnerships, and infrastructure investments, particularly as AI accelerates digital transformations across industries.

Global Infrastructure

Infrastructure Investments are on the Rise Globally

Germany has established a €500 billion special infrastructure fund to be invested over the next 12 years, aimed at modernizing energy, transport, and digital networks. This initiative allows for additional investments in infrastructure beyond the usual debt constraints, with €100 billion allocated specifically for state-level projects, particularly in heating and energy networks. The fund aims to ensure that these investments are supplemental, requiring the federal budget’s investment share to exceed 10% of expenditures in each financial year.8 Similarly, for its 2025 budget, the Indian government has allocated over ₹11.5 lakh crore for capital expenditure, emphasizing infrastructure development to stimulate economic recovery. This includes the establishment of a ₹1 lakh crore Urban Challenge Fund to support urban redevelopment projects. The budget also focuses on enhancing connectivity via significant investments in railways, highways, and ports.9

THE NUMBERS

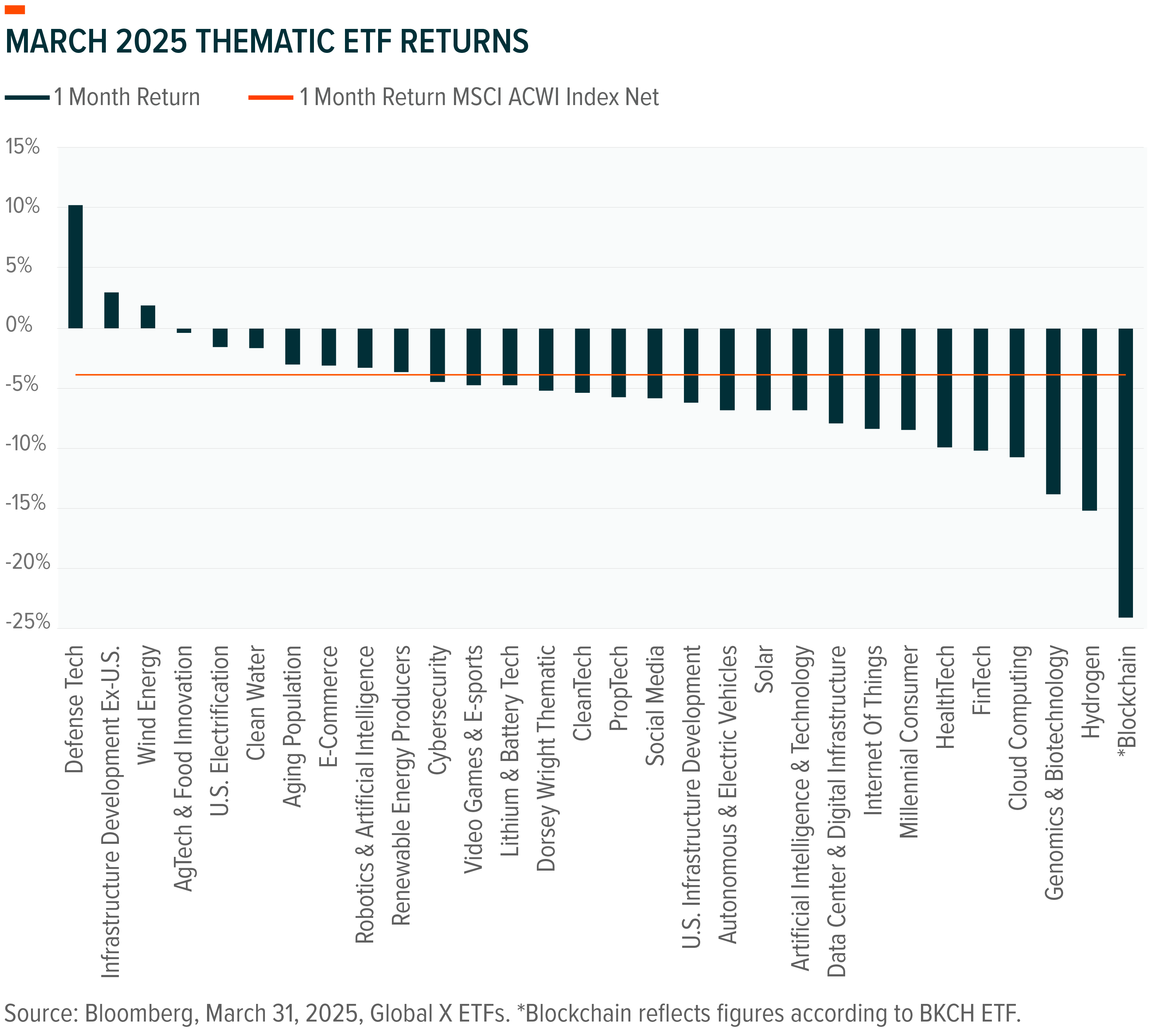

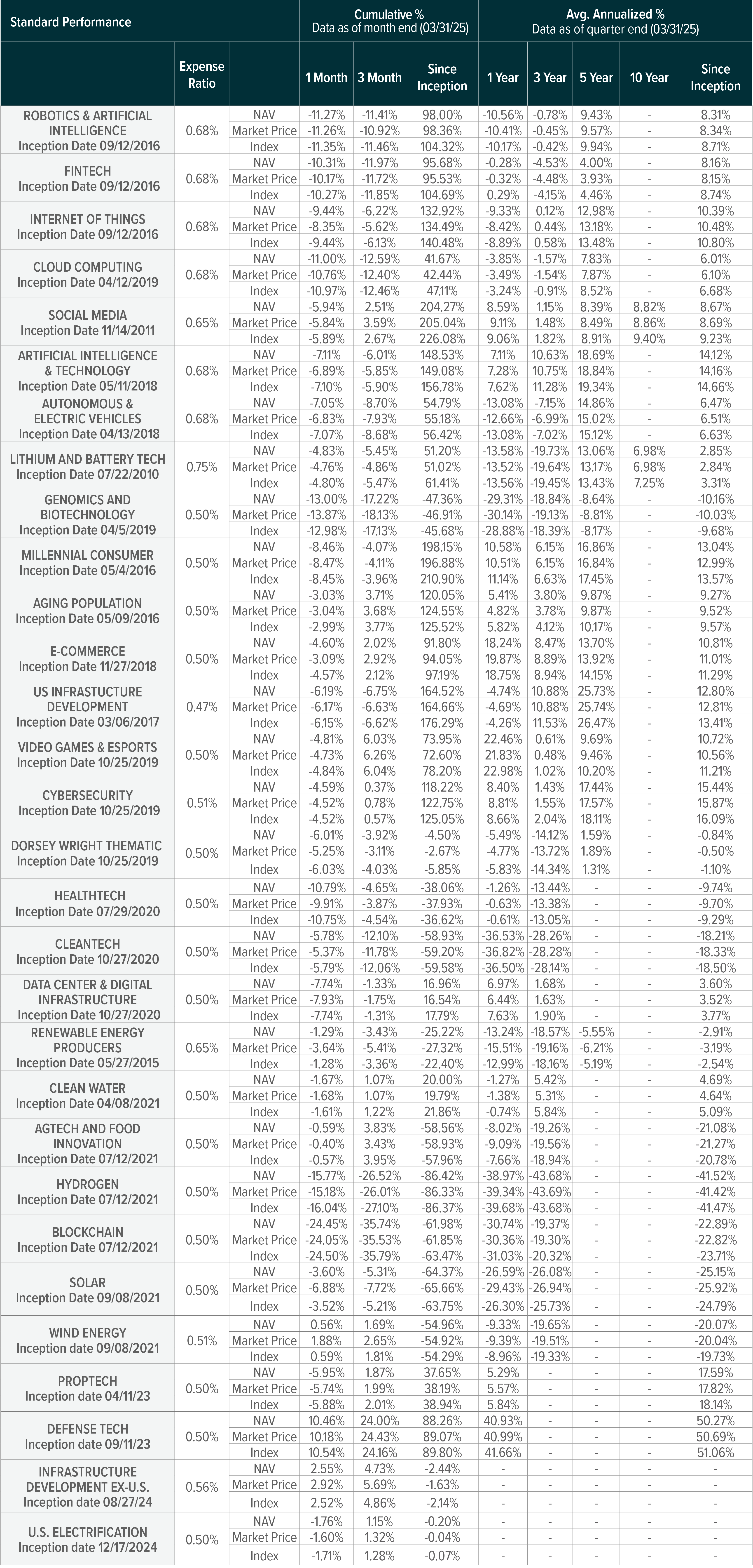

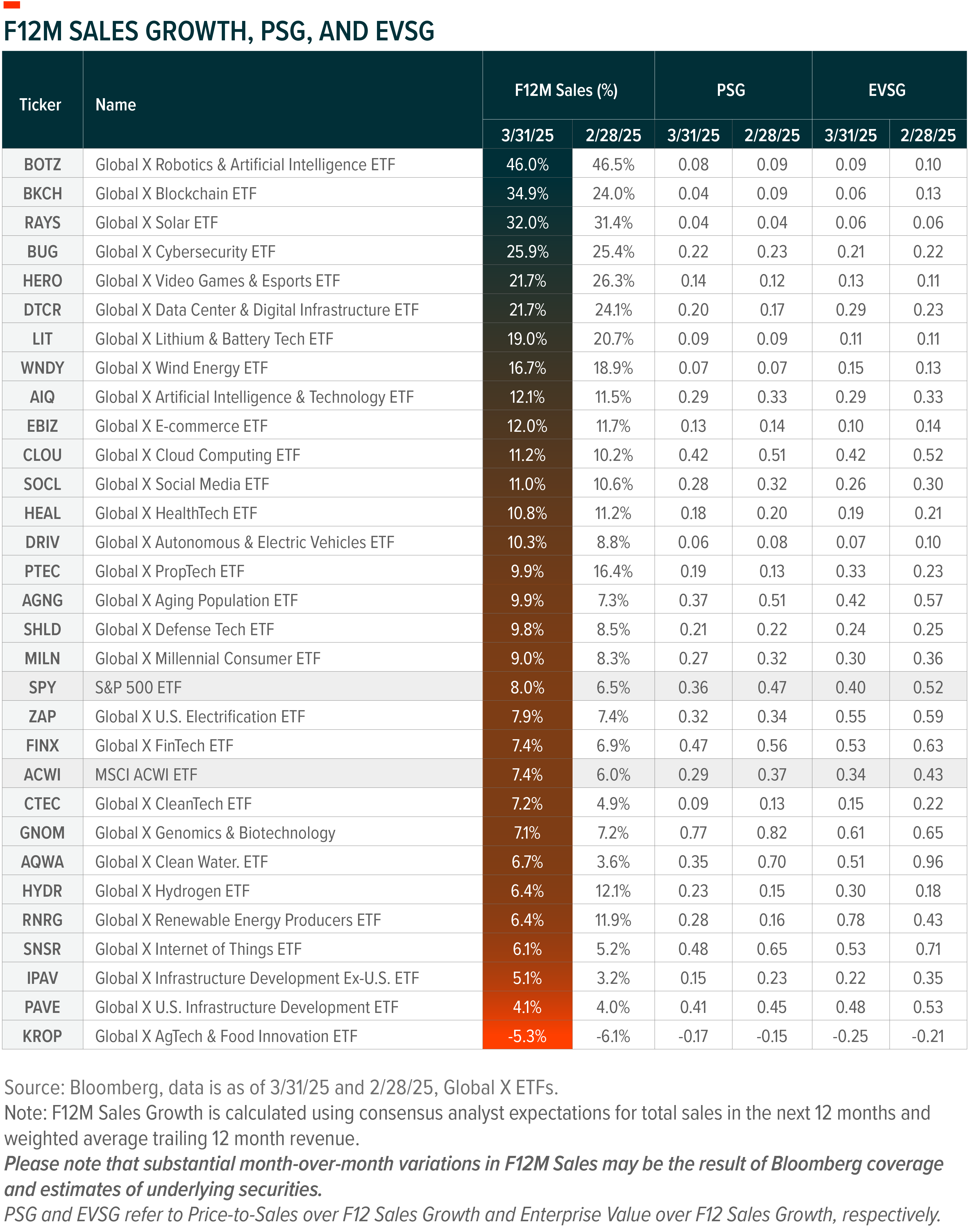

The following charts examine returns and sales growth expectations by theme, based on their corresponding ETFs or indices.

KEEP UP WITH THE LATEST RESEARCH FROM GLOBAL X

To learn more about the disruptive themes changing our world, read the latest research from Global X, including:

- Why HealthTech? Why Heal?

- How Agentic AI Could Catalyze Cloud Computing

- Four Companies Supporting America’s Electrification

- Rearming Europe Boosts Defense Tech

- CleanTech: Critical to Energy Security

ETF HOLDINGS AND PERFORMANCE

To see individual ETF holdings and current performance across the Global X Thematic Suite, including information on the indexes shown, click these links:

- Disruptive Technology: Artificial Intelligence & Technology ETF (AIQ), Blockchain ETF (BKCH), Robotics & Artificial Intelligence ETF (BOTZ), Cybersecurity ETF (BUG), Cloud Computing ETF (CLOU), Autonomous & Electric Vehicles ETF (DRIV), Data Center & Digital Infrastructure ETF (DTCR), FinTech ETF (FINX), Video Games & Esports ETF (HERO), Lithium and Battery Tech ETF (LIT), PropTech ETF (PTEC), Defense Tech ETF (SHLD), Internet of Things ETF (SNSR), Social Media ETF (SOCL), U.S. Electrification ETF (ZAP)

- Consumer Economy: Millennial Consumer ETF (MILN), E-Commerce ETF (EBIZ), Genomics & Biotechnology ETF (GNOM), Aging Population ETF (AGNG), Telemedicine & Digital Health ETF (EDOC)

- Infrastructure & Environment: U.S. Infrastructure Development ETF (PAVE), CleanTech ETF (CTEC), Renewable Energy Producers (RNRG), Clean Water ETF (AQWA), Hydrogen ETF (HYDR), Solar ETF (RAYS), Wind Energy ETF (WNDY), AgTech & Food Innovation ETF (KROP), Infrastructure Development ex-U.S. ETF (IPAV)

- Digital Assets: Blockchain & Bitcoin Strategy ETF (BITS), Bitcoin Trend Strategy ETF (BTRN)

- Multi-Theme: Thematic Growth ETF (GXTG)

Appendix: Thematic Expected Sales Growth Graph Indices

AgTech & Food Innovation: Solactive AgTech & Food Innovation Index

Aging Population: Indxx Aging Population Thematic Index

Artificial Intelligence & Technology: Indxx Artificial Intelligence & Big Data Index

Autonomous & Electric Vehicles: Solactive Autonomous & Electric Vehicles Index

Blockchain: Solactive Blockchain Index

Clean Water: Solactive Global Clean Water Industry Index

CleanTech: Indxx Global CleanTech Index

Cloud Computing: Indxx Global Cloud Computing Index

Cybersecurity: Indxx Cybersecurity Index

Data Center & Digital Infrastructure: Solactive Data Center REITs & Digital Infrastructure Index

Defense Tech: Global X Defense Tech Index

E-Commerce: Solactive E-commerce Index

FinTech: Indxx Global FinTech Thematic Index

Genomics: Solactive Genomics Index

HealthTech: Global X HealthTech Index

Hydrogen: Solactive Global Hydrogen Index

Infrastructure Development ex-U.S.: Global X Infrastructure Development Ex-U.S. Index

Internet Of Things: Indxx Global Internet of Things Thematic Index

Lithium & Battery Technology: Solactive Global Lithium Index

Millennial Consumer: Indxx Millennials Thematic Index

PropTech: Global X PropTech Index

Renewable Energy Producers: Indxx Renewable Energy Producers Index

Robotics & Artificial Intelligence: Indxx Global Robotics & Artificial Intelligence Thematic Index

Social Media: Solactive Social Media Total Return Index

Solar: Solactive Solar Index

U.S. Electrification: Global X U.S. Electrification Index

U.S. Infrastructure: Indxx U.S. Infrastructure Development Index

Video Games & Esports: Solactive Video Games & Esports Index

Wind Energy: Solactive Wind Energy Index

Ido Caspi

Ido Caspi